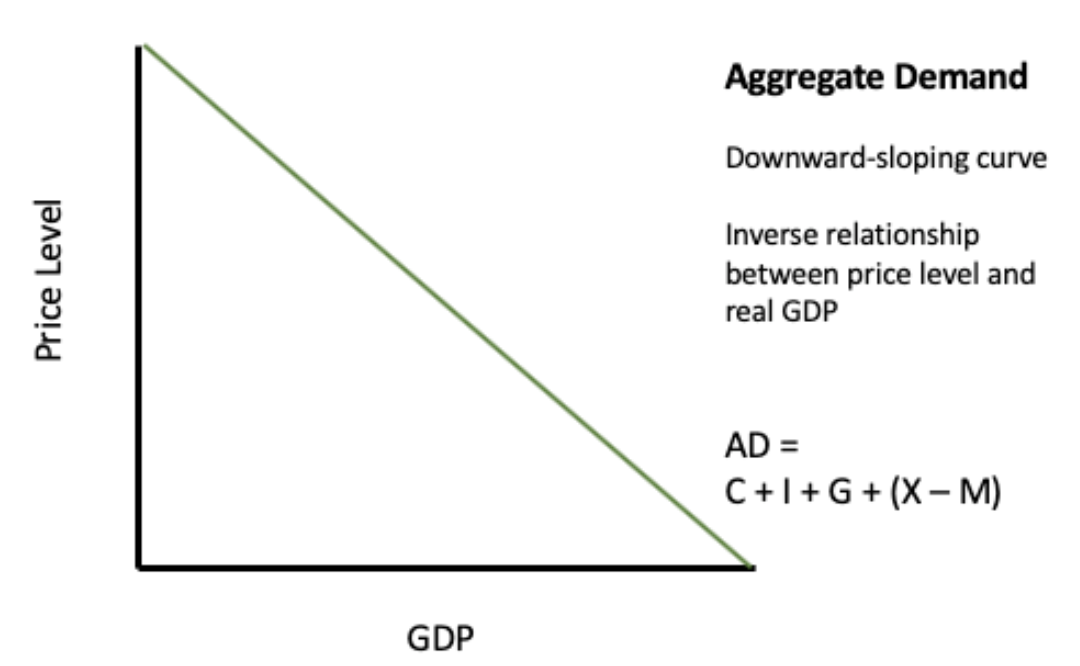

Let's begin by looking at the aggregate supply/aggregate demand graph. Notice that in microeconomics, the x-axis generally represents quantity, as in the quantity of one specific item, but here it represents overall quantity or all output in an economy, which is GDP.

The y-axis represents the overall price level, not just the price of a specific item.

This is the most common graph that we are going to be using in macroeconomics to show overall, or macroeconomic, activity.

We will start by discussing aggregate demand, abbreviated as AD. It is the total amount of goods and services demanded in the economy at a specific point in time and at a prevailing price level.

Here is what an aggregate demand curve looks like. Notice the formula in the lower left-hand corner:

If you recall from the tutorial on GDP, GDP equals consumer purchases, investment outlays by businesses, government spending, and net exports. This is what comprises aggregate demand.

So, would aggregate demand really comprise the sum of all demand curves for everything in the economy? Well, sort of, but let's think about it differently.

In microeconomics, demand curves slope downward because as the price of something specific falls, people buy more of it. We cannot use this same analysis when looking at aggregate demand.

However, there are three reasons why aggregate demand slopes downwards:

The part of aggregate demand that is increasing here is the C-component. Consumer purchases will increase due to this wealth effect as prices fall. The wealth effect is defined as the perception that wealth has increased, resulting in an increase in consumption, or the C-component of the aggregate demand formula.

As interest rates fall, people will buy more items that require loans, like cars, houses, appliances, and furniture--items considered to be durable goods.

Again, this is impacting that C-component of the aggregate demand formula, though it refers to a different type of consumer purchases, those requiring loans.

Also, falling interest rates will impact business investment. Businesses will take advantage of lower rates and invest more in their companies. Basically, we see the C and I being impacted on anything that is interest sensitive, due to the interest rate effect as the price level falls.

Therefore, the interest rate effect is as interest rates fall, consumption increases due to the decrease in the cost of borrowing. As a result, purchases and business investment (Consumption, C, and Investment, I, respectively) both increase.

When that happens, foreigners will try to take advantage of it by buying more from us, so exports (X) are going to increase.

At the same time as our exchange rate falls, our dollars will not go as far when purchasing items from other countries. Therefore, we buy less from other countries and imports (M) decrease.

Exchange rate movements impact demand. Domestic currency depreciation--meaning as our price level comes down, our exchange change rate comes down--increases the cost of imports, resulting in a potential decrease in imports, or M. The lower domestic exchange rate also increases foreign demand for domestic goods, increasing our exports, or X.

Now let's turn our attention to aggregate supply. There are two aggregate supply curves.

In the short run, the aggregate supply curve does slope upward, as shown below.

Again, aggregate supply is the total amount produced at various price levels. It slopes upward in the short run because businesses can actually produce more as the price levels rise, for several reasons:

Therefore, in the short run, aggregate supply can slope upwards. As prices go up, they can choose to produce more, while as price levels fall, they can produce less.

The idea here is that we can ramp up our production in the short run, but this can really only get us so far. In the long run, we have a limited amount of resources, such as materials and workers. Therefore, that vertical line represents the current potential for how much we can produce.

Now, in order for that potential or production capacity to change, something else would need to change to increase our ability to produce more.

EXAMPLE

The invention of new technology might increase production capability and shift the supply curve over and to the right.Now, the intersection of the short-run aggregate supply curve and the aggregate demand curve will give us equilibrium.

The Y*--note that it is now on the x-axis--represents the equilibrium level of production or output, also known as real GDP.

P* on the y-axis represents our current price level.

In upcoming tutorials, we will be using this graph to show what happens to the new equilibrium price level and real GDP, when anything changes like aggregate demand or aggregate supply.

Source: Adapted from Sophia instructor Kate Eskra.