In this lesson, you will learn how to use capital assets to produce income and build wealth. You will better understand how strong technology and problem solving skills can play a role in that process. Specifically, this lesson will cover:

1. Overview of Capital Gains

According to the Bloomberg Billionaires Index, Jeff Bezos, founder of Amazon.com, is the wealthiest living American. His net worth is an estimated $125 billion as of March 3, 2018. Mr. Bezos, and most other financially successful individuals, gain their wealth by creating or buying businesses, managing these “investments,” and reaping the increased value of these holdings. Stated differently, these individuals become wealthy through the generation of capital gains. Although it is not everyone’s financial goal, many people strive to maximize wealth over their lifetime financial journey.

-

- Capital Gain

- Increased value of capital holdings.

1a. Capital Assets

To understand how assets can help you accumulate wealth, it is first necessary to be familiar with what it means to own capital. The Internal Revenue Service (IRS) says that almost everything you own or use for personal or investment purposes is a capital asset. Common capital assets include:

- Your home

- Your car

- Investments like stocks, bonds, and mutual funds

- Ownership interest in a small business that you start

- Rental or other real estate that you own

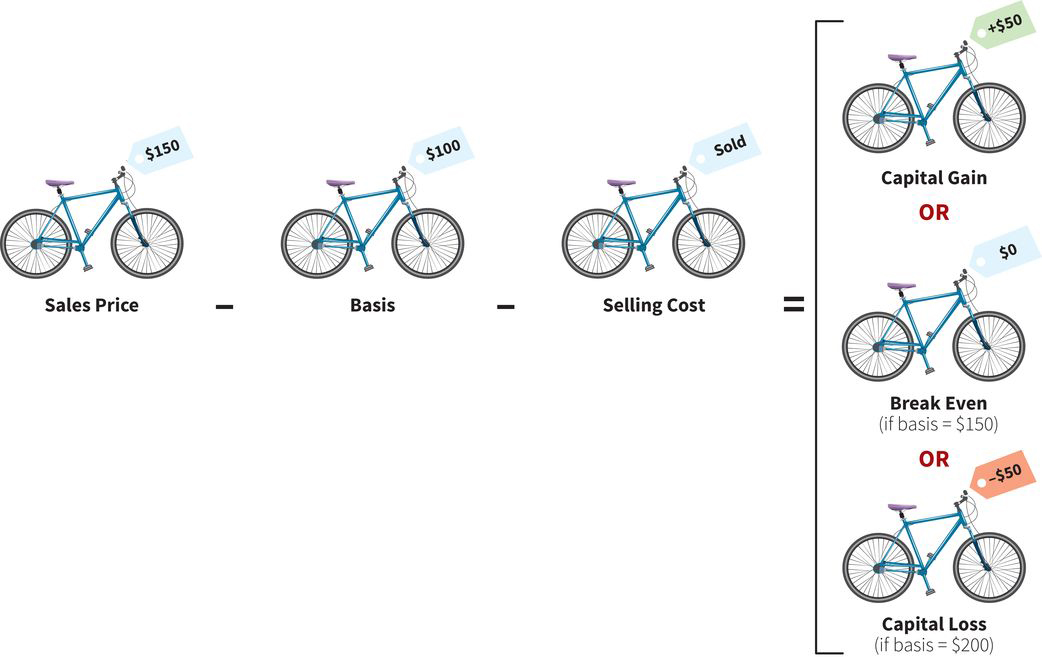

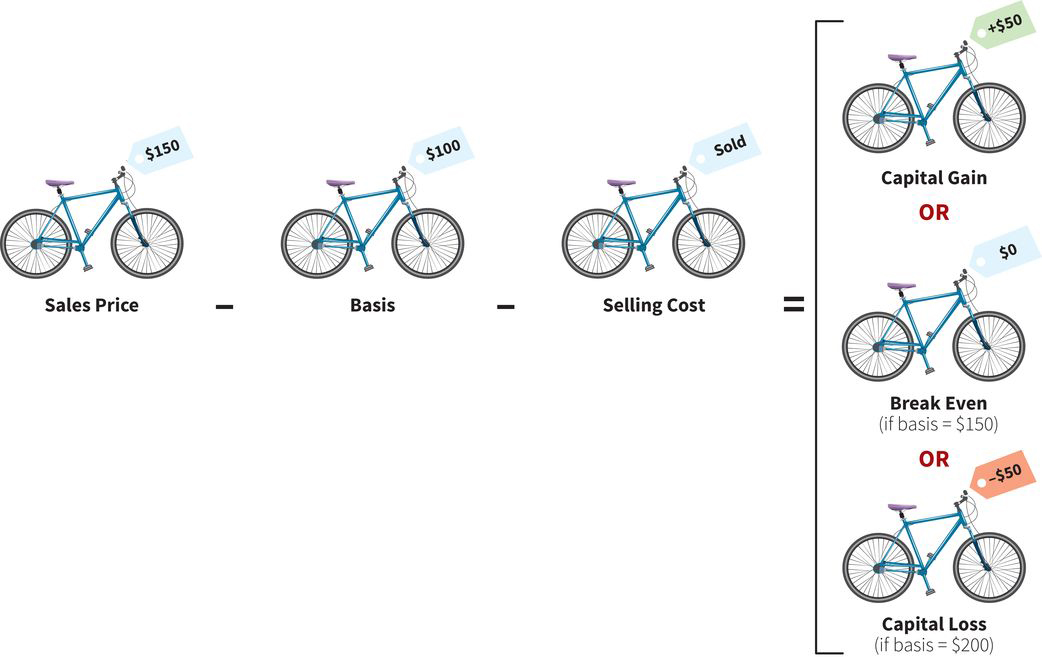

When you buy a capital asset, the price you pay is called your

basis. When you later resell the asset, one of three things will happen:

- If you sell the asset for more than you paid for it, you will have a capital gain.

- If you sell the asset for less than what you paid for it, you will have a capital loss.

- You will break even on the sale if the price equals your basis.

-

- Capital

- The money used to start or expand a business.

- Capital Asset

- Everything you own or use for personal or investment purposes.

- Basis

- The price you pay when you buy a capital asset.

- Capital Loss

- Selling an asset for less than what you paid for it.

1b. Calculating Capital Gains

Current U.S. tax law requires you to report all capital gains (the amount in excess of what you paid for the asset) for tax purposes. If you have a capital loss, however, only losses coming from the sale of an investment can be reported to the IRS. Some of these losses may reduce your tax liability. Losses on the sale of personal assets, such as your car or home, are not reported to the IRS and do not reduce your taxes.

- It is important to understand that you will only realize a capital gain or loss if you sell or exchange your capital asset for more than you purchased it.

- For example, if you own an investment that increases $10,000 in value but you do not sell the investment, you will not have to pay tax on the increase in value of the asset until you sell or exchange it.

The following illustration shows the basic formula for calculating a capital gain.

-

- Capital Gain

- Simply subtract your basis and what it costs to sell the asset (commissions and fees) from the sales price.

.

.

As noted above, three outcomes are possible when you apply the formula from above:

- Profit: Sales Price > (Basis + Selling Cost).

- Break Even: Sales Price = (Basis + Selling Cost).

- Loss: Sales Price < (Basis + Selling Cost).

-

EXAMPLE

Suppose you purchase a one-bedroom condo for $70,000 to live in while you attend school. The condo is considered a capital asset. Why? Because you now own it and it has some value. Now let’s say that you graduate and sell the condo to someone else for $77,000. What is your capital gain or loss?

- The basis is your purchase price of the property ($70,000).

- The sales price is what you sell the condo for ($77,000).

- The selling cost includes real estate and legal fees. In this case, assume you sell the condo through a real estate agent who charges 6% of the selling price. Your selling cost will be $4,620 ($77,000 × 0.06).

- Using the capital gains formula, your realized gain is $2,380 ($77,000 – $70,000 – $4,620).

Strong technology skills will allow you to use tools like Excel and Google Sheets to make calculations like the one above. Taking the time to learn more about those tools, like how to use formulas and calculations, can help you be precise and save time.

You can convert the realized gain into a percentage rate by dividing the gain by the basis. In this case, the gain is 3.40%. This is shown in the following table.

|

Selling Price

|

$77,000

|

Basis (purchase price) Basis (purchase price)

|

$70,000 $70,000

|

Selling costs Selling costs

|

$4,620 $4,620

|

|

= Realized capital gain

|

= $2,380

|

Percentage rate increase ($2,380  $70,000) $70,000)

|

= 3.40%

|

You may not get rich after selling your first condo. What really matters, though, is owning assets that will go up in value in the future. This is precisely what the 10 richest Americans did. They created companies and owned investments that grew in value over time. As those assets went up in value, so did their net worth. They used their problem solving skills to determine the best investments to build their wealth.

-

Going forward, you need to include capital assets in your overall financial plan as sources of wealth accumulation and unearned income.

-

Sarah wants to determine whether her investments have generated a capital gain over the past year.

|

Investment

|

Basis

|

Commission Paid to Purchase

|

Commission Paid to Sell

|

Current Price

|

|

WOLF stock

|

$1,000

|

$ 50

|

$50

|

$1,200

|

|

RAIDER bond

|

$3,000

|

$100

|

$0

|

$3,000

|

|

CAT stock

|

$1,500

|

$50

|

$50

|

$1,550

|

|

Silver coins

|

$900

|

$0

|

$0

|

$700

|

|

Gold jewelry

|

$2,300

|

$0

|

$75

|

$2,400

|

Using this information to answer the following questions.

Calculate the gain or loss for each investmentGain or Loss

- WOLF stock: $100 gain ($1,200 – $1,000 – $50 – $50)

- RAIDER bond: $100 loss ($3,000 – $3,000 – $100 – $0)

- CAT stock: $50 loss ($1,550 – $1,500 – $50 – $50)

- Silver coins: $200 loss ($700 – $900 – $0 – $0)

- Gold jewelry: $25 gain ($2,400 – $2,300 – $0 – $75)

-

- Realized Gain

- When an investment is sold for a higher price than what it was purchased for.

2. How to Achieve Capital Gains

The concept of capital gains is relatively straightforward.

-

- You buy or somehow obtain an asset.

- You hold the asset for some length of time, usually enough time to allow it to go up in value.

- You sell the asset.

If you make money by getting more than your basis plus transaction costs, you have a capital gain. If you lose money, you have a capital loss. If you neither make nor lose money, you break even.

2a. The Basis of Assets

The basis of property, or your cost of the asset, has an impact on your capital gain outcome. The concept of basis can get complicated. Here is a simple way to think about basis.

- The basis of investment assets (such as stocks) you purchase is generally the purchase price plus any costs of acquiring the asset, such as commissions and recording or transfer fees.

When you use investment earnings to purchase more of the underlying investment, the basis of your investment increases. Reinvesting dividends is a common example of this practice.

- If you obtain an asset from someone else as a gift, then your basis is usually the lesser of the fair market value (FMV) when you receive the property or the previous owner’s adjusted basis.

- If you inherit an asset because someone died, your basis becomes the fair market value as of the person’s date of death. This is called receiving a stepped-up basis. The tax implications of receiving property in an inheritance is usually better because the new basis will be higher, which reduces the amount of the capital gain.

2b. Value of Assets

Note that it is not necessary to sell something to reap the rewards of owning a capital asset. In fact, the 10 richest Americans have rarely sold the assets that made them wealthy!

-

- The key to generating wealth through capital assets is to own property and investments where an active marketplace exists.

- Value is determined in the marketplace based on what buyers are willing to pay sellers for capital assets.

Let’s see how one of the richest Americans got that way. As you may already know, as a young man, Bill Gates co-founded Microsoft. As a co-creator, Gates owns millions of shares in his own company that he did not have to buy (although he did invest much of his own money and time in creating the company). When Microsoft was a new company, you could invest in the firm by buying shares for a mere 7 cents. In 2016, one of those shares was worth more than $50. You can see the price history of Microsoft in the following line chart.

Over the 30-year period between 1986 and 2016, the value of Microsoft stock increased at close to a 30% annual rate. Using the Rule of 72, you know that Bill Gates has doubled his wealth from the company approximately every 2½ years (72 ÷ 30 = 2.4). Even though he rarely sells his shares, the market value of the shares continues to increase. The takeaway here is this: Follow in Bill Gates’ footsteps by taking the following actions.

-

- Buy assets that have the potential to go up in value.

- Hold those assets over the long term.

- Let the power of compounding generate unearned income.

You just might be able to live off your investment income sooner than you thought you could!

In this lesson, you received an overview of capital gains which is money you make from the sale of an asset. Some common capital assets include your home, car, investments, and any ownership in a small business. Calculating capital gains is simple: subtract the basis and any fees or commissions from the sales price. Strong technology skills can help you with these calculations. Knowing how to achieve capital gains can grow your wealth. The amount of capital gains is influenced by the basis of an asset, or the price you originally paid for it. Value of assets is not only realized through the sale of the asset but also by owning property and investments in an active marketplace. Strong problem solving skills can help you make sure you select the best investments.

Source: This content has been adapted from Chapter 3.5 of Introduction to Personal Finance: Beginning Your Financial Journey. Copyright © 2019 John Wiley & Sons, Inc. All rights reserved. Used by arrangement with John Wiley & Sons, Inc.

Wiley and the Wiley logo are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries.

.

.

Basis (purchase price)

Basis (purchase price)

$70,000

$70,000

Selling costs

Selling costs

$4,620

$4,620

$70,000)

$70,000)