Table of Contents |

The subject company for our case study is called Legacy Realty. Legacy Realty is a sole proprietorship, which is a type of company that is owned by one single individual, and where that individual and the business are legally treated as the same.

The purpose of Legacy Realty as a business is to own, lease, and manage its own rental properties. It purchases houses and condominiums and leases them out to tenants. They also perform their own management of their units, making repairs, performing maintenance, and collecting rent. Legacy Realty is located in Washington DC, and they have a small staff of five people.

| Legacy Realty | |

|---|---|

| Type of company | Sole proprietorship |

| Business purpose | Own, lease, and manage rental properties |

| Business location(s) |

Washington, D.C. Staff of 5 people |

Legacy Realty needs a statement of changes in owner's equity to determine business performance. It details the owner activity, such as investments in the business and taking money out, to determine if there has been net income or net loss. This statement helps Legacy Realty to understand the change in owner's equity for a period; it's an activity-based statement, similar to the income statement, that generally covers one year or less of activity.

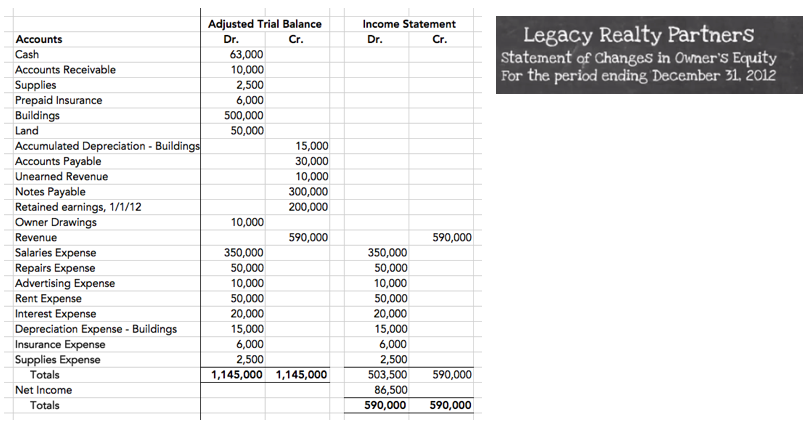

Let's begin preparing a statement of changes in owner's equity for Legacy Realty. We'll start with the trial balance worksheet because we need to pull some information from it in order to prepare the statement.

Here is the trial balance worksheet. Here's what we've done so far:

This adjusted trial balance is going to be the source for the financial statements for Legacy Realty, so we are ready to prepare their statement of changes in owner's equity.

Just as with other financial statements, we start with the header: the business name, Legacy Realty Partners, then "Statement of Changes in Owner's Equity," and finally, a line that says "For the period ending December 31, 2012." Similar to the income statement, this line is needed because this is an activity-based statement.

Again, here is the information from the adjusted trial balance, reflecting the permanent accounts--assets, liabilities, and equity. Equity is the key piece. We will also need to pull some information off of the income statement in order to prepare the statement of changes in owner's equity.

The first line is the beginning balance, January 1, in owner's equity, which is retained earnings in the amount of $200,000.

Next, we're going to add any owner investments or net income. In this case, Legacy Realty has net income of $86,500. There were no owner investments during the period, so the only item we need to add is net income. We subtotal the beginning balance and net income to get $286,500.

Now we need to take out any subtractions for owner's draws, meaning any money the owners pulled out of the business, as well as any net loss. Well, we know that Legacy Realty had net income, so the only item we need to subtract are the owner's drawings, shown in the adjusted trial balance.

We subtract owner draws to get to the Legacy Realty's ending balance on December 31, 2012, of $276,500 in owner's equity.

Source: Adapted from Sophia instructor Evan McLaughlin.