Table of Contents |

Before we begin discussing debits and credits, it is important to set the stage with a critical concept: the basic accounting equation. The basic accounting equation is assets equal liabilities plus owner's equity:

The most important thing to note is that this equation must always balance. Keep this in the back of your mind during the discussion of debits and credits; when reviewing the different debits and credits within the accounts, make sure that this equation is always in balance.

Each account is a member of one of the account groups. Each account provides a greater level of detail for the resources impacted within the account groups.

| Account Group | Account |

|---|---|

| Asset |

Cash Accounts Receivable Supplies Long Term Assets |

| Liability |

Accounts Payable Notes Payable Utilities Payable |

| Equity | Equity Owner's Withdrawals |

| Revenue |

Service Revenue Rent Revenue |

| Expense |

Wages Expense Utilities Expense Advertising Expense |

Now we are ready to discuss debits and credits, starting with debits. A debit is an entry that is made on the left side of an account. A credit, on the other hand, is an entry made on the right side of an account.

Now, why do we use debits and credits? Well, debits and credits are used to show monetary changes within individual accounts. They help to keep a detailed record of all the increases and decreases within accounts, account groups, and financial statements. So, debits and credits can either be increases or decreases; it simply depends on the type of account.

| Account Group | Debit | Credit |

|---|---|---|

| Asset | Increases | Decreases |

| Liability | Decreases | Increases |

| Equity | Decreases | Increases |

| Revenue | Decreases | Increases |

| Expense | Increases | Decreases |

Circling back to the accounting equation, another thing to remember about debits and credits is that in total, your debits must always equal your credits. This is very important when you are looking at entries within your specific accounts: the debits in total must always equal the credits in total.

If you have a cash sale in your business, there will be two accounts impacted:

Now, let's look at the revenue. Remember, you had $1,000 cash debit, so you're also going to credit revenue for $1,000. Again, your total debits equal your total credits for that cash sale.

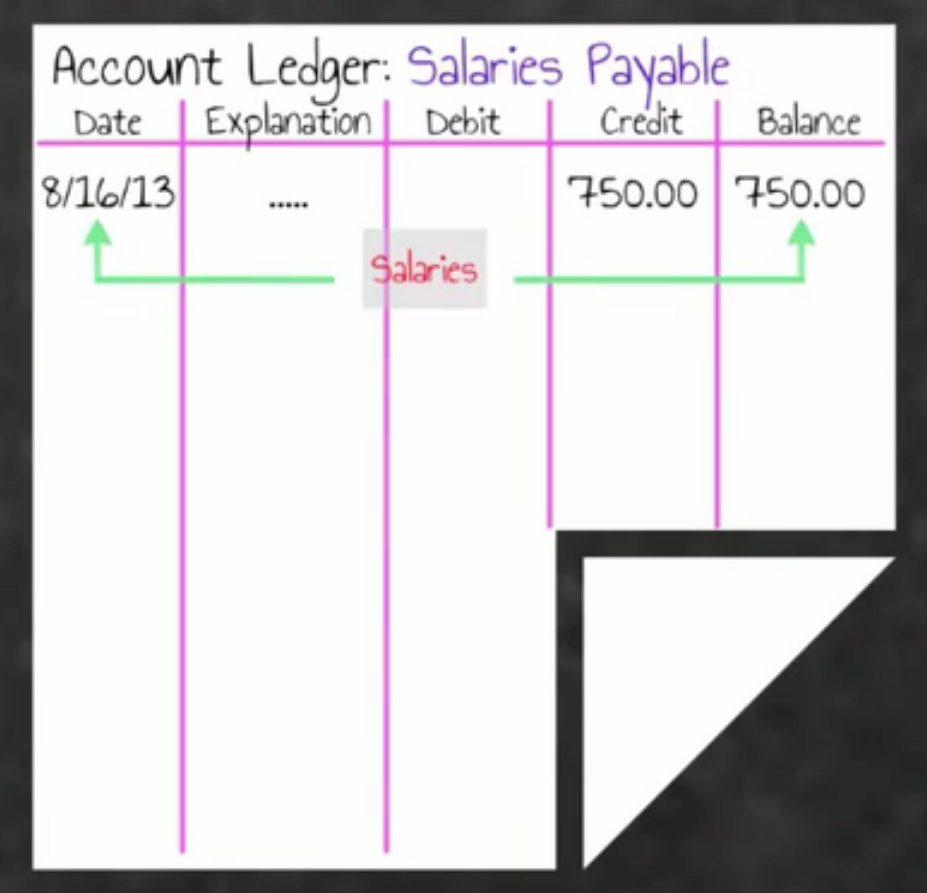

Our next example involves salaries. There will be two accounts impacted:

Next, you'll need to have a corresponding credit, and that credit is to your liabilities. In other words, it's money that you owe. If you look at your salaries payable for the salaries that you owe, you will see a credit in that salaries payable. Once again, your total debits of $750 equal your total credits of $750.

Suppose you are an owner who is contributing cash to a business. There will be two accounts impacted:

It follows, then, that you will see a corresponding debit of equal value. In the image below, you can see that cash came in. You received cash from that contribution, so your cash is debited for $2,000--and your total debits of $2,000 equal your total credits.

Source: Adapted from Sophia instructor Evan McLaughlin.