Table of Contents |

The expanded income statement starts with sales minus cost of goods sold, which equals gross profit. We then subtract out operating expenses to arrive at income from operations. Finally, we add other revenues or subtract other expenses to equal net income.

Let's dive a little bit deeper into the sales component of the formula. Sales represents our revenue, or earnings from interest or from the sale of goods or services. A sale is the selling of inventory by a merchandising business.

We can get revenue from a couple different sources--from the sale of inventory or from earnings from interest. Any sales from goods or services will apply to that top line. However, we can also have other revenue items, like interest revenue, which would be listed at the bottom of the expanded income statement.

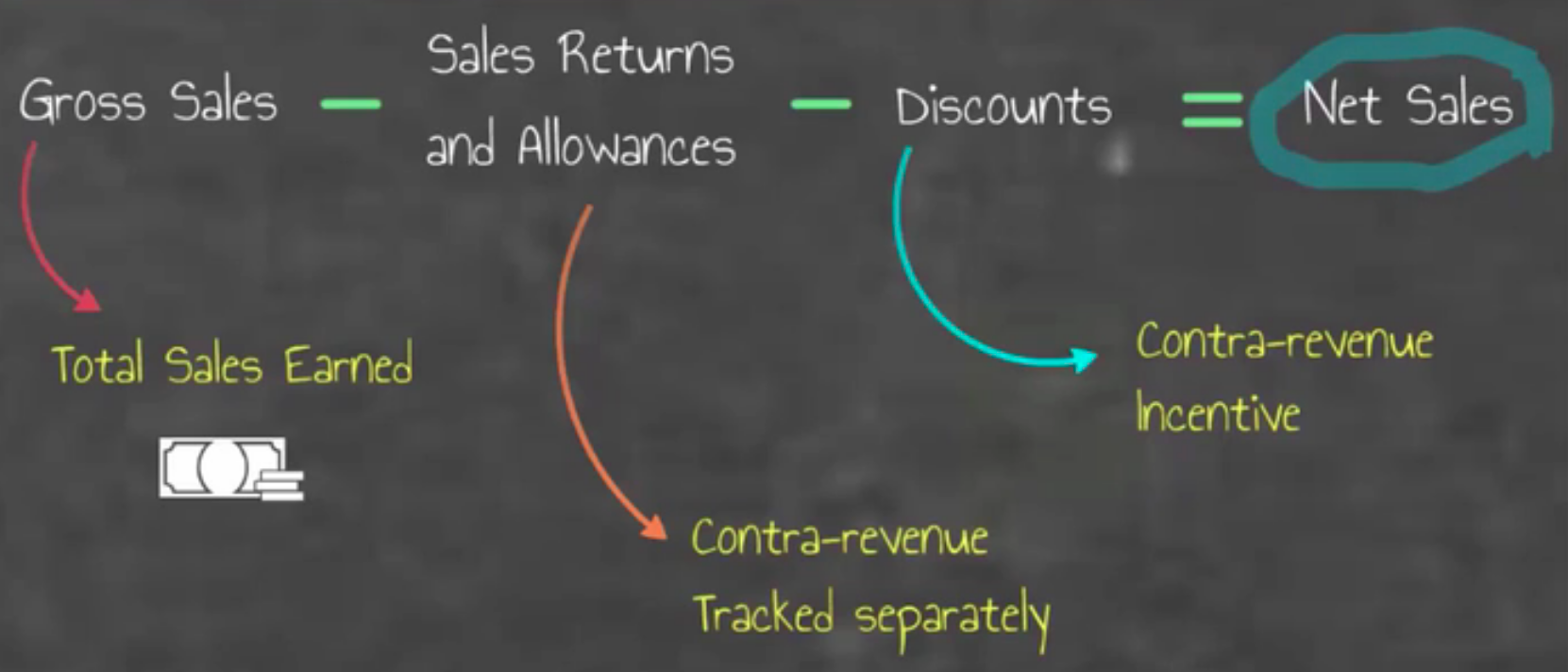

Next, let's look at the expanded sales calculation. Starting with gross sales, we subtract out sales returns and allowances, and subtract out discounts, to equal net sales.

Now let's look at another component of the expanded income statement. Refer back to the expanded income statement above, and the line item stating "cost of goods sold."

When you see cost of goods sold on the expanded income statement, there are actually a couple additional calculations that go into that final number. We also have to calculate cost of goods purchased and goods available for sale to arrive at the final cost of goods sold.

Let's perform a cost of goods sold calculation:

However, we can go even further by looking at cost of goods purchased, starting with purchases, which refers to the buying of inventory for resale to customers, or assets such as supplies or equipment for cash or credit.

So, starting with our purchases, we would subtract out discounts, and subtract out purchase returns and allowances to equal net purchases. Next, we would add freight-in, which would total the cost of goods purchased. This is how we calculate cost of goods purchased within the cost of goods sold calculation.

There is one final item related to the expanded income statement. Expenses are costs associated with operating or maintaining a company.

Now, there can be operating expenses, as you can see on the expanded income statement. These are generally categorized as sales expenses, meaning expenses that relate to generating sales, and also general and administrative expenses, which are simply general expenses of operating a business, and not necessarily directly related to generating sales.

In addition, there are non-operating expenses, which are the expenses that are put into that "other revenues and expenses" category. These non-operating expenses are listed at the bottom of the income statement.

Source: Adapted from Sophia instructor Evan McLaughlin.