Let's begin with a definition of fiscal policy, which is typically policy set by a central government authority, whereby spending by the government is adjusted to stabilize economic activity.

The government also uses taxation as a policy to do the same.

Therefore, we have two tools of fiscal policy:

Now, fiscal policy looks at the policies in these two areas, and the government uses these two tools to stabilize the economy's movement through business cycles.

As a reminder, business cycles are the movement of an economy through expansion, peak, contraction, and trough over time. It is an assessment of our economic activity through time.

In review, this is what a business cycle looks like. Notice the expansion, peak, contraction, and trough; then, the cycle would start over.

It is usual for the economy to go through periods of growth and contraction, but fiscal policy's goal is to make sure that expansions are not too rapid, experiencing a lot of inflation, and contractions are not too severe, ending up in major recessions or even depressions.

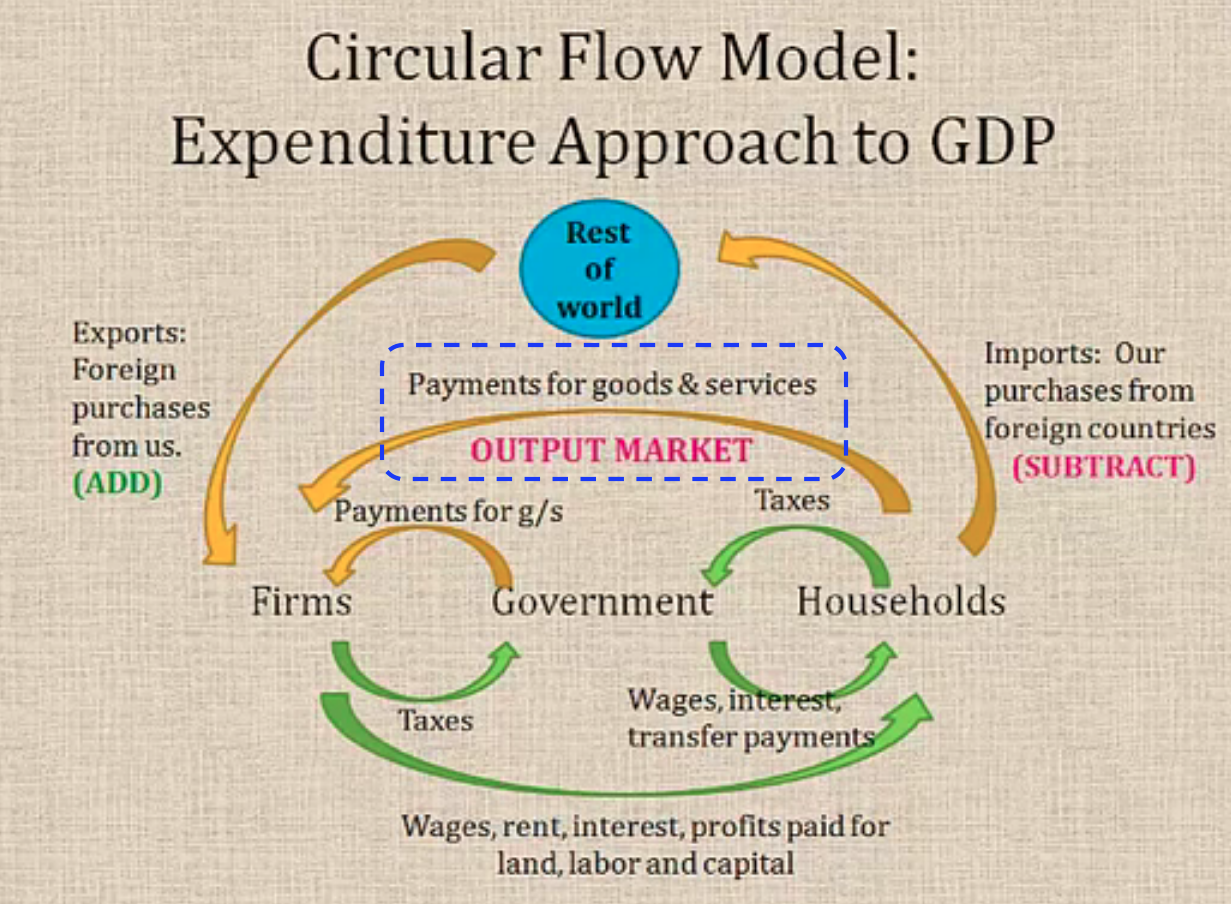

Now let's talk about spending in the economy, circling back to the expenditure approach. You may recall that the expenditure approach to calculating GDP or economic activity does this by adding up what people are spending in the economy.

This is the activity in the output market from our circular flow model.

Notice the money being spent up at the top. In this case, we are only going to focus on domestic, so we are going to take the imports and exports, and the rest the world out of this equation. We will be looking at movement in the output market on goods and services.

Here is the expenditure formula and its component parts:

For now, we are going to take (X - M) out of the equation, because we are just considering domestic.

So, if we only consider domestic spending, then there are basically three ways money is spent in our economy:

Therefore, our formula for GDP or economic activity becomes:

If we add and subtract T, which represents the taxes collected, this provides:

In this formula, Y minus C plus T is our public savings, and T minus G is our government savings.

We will come back to these shortly to show the impact on government savings.

Savings are defined as income that is not consumed or paid in the form of taxes.

Sometimes, the term investment creates some confusion with students in economics, because they associate the word investment with investing in the stock market or portfolio investments.

Investment in economics is defined as money that is used on capital resources. For businesses, this would be land, equipment, or buildings. For individuals, it could be something like a home. It is not portfolio investment, so not to be confused with the purchase of stocks, bonds, and other wealth accumulation related investments.

As mentioned at the beginning of this tutorial, the government has two tools of fiscal policy: government spending and taxation.

Now, the government's role in the formula for real GDP is that if the government wants to stimulate the economy, it can spend more money in order to create jobs or give people money to spend.

If it needs to slow down an overheated economy where inflation is a concern, it can cut spending levels.

If they want to stimulate the economy, they can cut taxes to give people more money to spend in the economy.

If they need to slow it down, they can raise taxes to slow down our spending--essentially taking money out of our pockets.

Again, considering only domestic, we had these formulas of public savings and government savings.

During recessions, government spending should be greater than taxation.

During recessions: G > T

As mentioned, during recessions, the government wants to cut taxes and give us more money, but at the same time, they could also be increasing government spending by creating more programs and giving people more money to spend.

Therefore, you can see why the term T minus G is going to be negative if government spending is greater than taxation. This means that government savings during recessions would be negative. Instead of having savings, the government would be in debt or running a deficit.

In expansions, in theory, T should be greater than G to offset these deficits that we have incurred during the recession.

In expansions: T > G

Once we recover, taxes should be increased again and/or government spending programs should be cut down.

However, this is politically difficult. Once the government cuts people's taxes, it is never popular to raise them again. Once it creates government programs, it is not popular to eliminate them.

In reality, it is easy to see why our government deficit has grown so much over the years.

Source: Adapted from Sophia instructor Kate Eskra.