In this lesson, you will examine the benefits of insurance to protect the personal and real property of homeowners and renters. You will consider how problem solving skills can help you review your options. You will also better understand how technology skills can help you track covered items. Specifically, this lesson will cover:

1. Insurance Purchase Considerations

There are three factors to consider when it comes to buying property insurance.

- You need to know the perils that you face as a homeowner or tenant.

- You need some idea about the probability of a loss occurring and the severity of the loss if it occurs.

- You need to determine your budget and how much you can spend on insurance premiums.

-

When you buy a house, the lender will require proof of insurance, sometimes dictating specific coverage.

Although you might want to have insurance to protect against every possible loss, for most people this is not practical. Your insurance premiums would require too much of your free cash flow, leaving you insurance-rich but cash-poor. Instead, you should use a risk process as a guide to insuring your home and property, such as the following:

- Only buy insurance when an event is relatively unlikely to happen, but when it does, the cost is high (floods, theft, fire, etc.).

- Some risks can be retained or self-insured (that is, you will pay for it yourself) because even though the event may happen regularly (high probability), the cost of loss is low. Think of small home repairs, such as most plumbing issues, as being something you can self-insure.

- Some things happen very rarely, and even when they do, the cost of loss is low. These risks can be reduced (and not covered by insurance). For example, to avoid clogging pipes in the shower, a family can be diligent about using a hair catcher.

- There are some risks you should avoid simply because the probability of occurrence and the cost is high. For example, you should never smoke in bed.

In your personal finances, you can use your problem solving skill to make visualizations about competing insurance plans or to recognize how much a damage or loss would cost you if you were not insured.

-

- Peril

- Anything that causes you to experience a loss.

2. Homeowner’s Insurance

When you buy a home, your mortgage company will require that you purchase a homeowner’s coverage policy (HO policy). There are two main types of HO policies.

- A named perils policy, as the name implies, will only pay you if your loss is caused by something specifically listed in the policy (e.g., fire or smoke). These policies may be appropriate for a summer cottage or a low-value home.

- Typically, you will want instead a special perils HO policy. These policies will pay for any loss unless the peril is explicitly excluded in the policy, such as earthquakes, war, and mold.

-

It is possible to purchase separate insurance for each excluded peril in a special perils HO policy.

-

- Homeowner’s Coverage Policy (HO Policy)

- Covers either named perils or all risks.

2a. HO Policy Coverage

An HO policy typically consists of six parts:

- Replacement for your dwelling and personal property (you do not need to insure your land because your home may disappear, but your land will still be there).

- Replacement for other structures on the insured property (limited to 10% of Part 1).

- Replacement for personal property (typically limited to 50% of Part 1).

- Loss of use payments (limited to 10–50% of Part 1).

- Liability coverage (typically $100,000).

- Medical payment coverage for others injured on your property ($1,000 per person limit).

The cost of your HO policy (the premium) will depend on:

- The values purchased in Parts 1 through 6 and the location of your home. The higher the policy limits, the greater the premium. For example, you can increase your liability coverage under Part 5, but doing so will increase the annual premium.

- The type of HO policy. A special perils HO policy will always cost more than a named perils policy.

- The amount of your deductible. Similar to auto insurance and health insurance, HO policies also have deductibles. Higher deductibles will result in lower premiums.

- The age of your home, how close you are to a fire station and fire hydrant, as well as other risk factors.

- Your credit score. You can expect to pay less in annual premiums as your credit score increases.

- How frequently you make claims and the type of claims made.

-

If you have borrowed money to purchase your home, your lender may require you to carry a low deductible, which will increase your premium.

As a final note, once you have insurance, you should be cautious when making claims. Your insurance company will track how many claims you make against your policy. If you have a high number of claims, your policy premium will increase. In some cases, your policy may be canceled by an insurance company.

Strong problem solving skills

can help you determine if making a claim is a wise decision. You can contact your insurance carrier to discuss any potential claims before they are filed. They can help you understand if it might be a better financial choice to pay out of pocket.

2b. Managing Your HO Policy

When it comes to buying and managing an HO policy, here are a few rules you should follow:

- 1. Inventory everything you own. This means videoing all your valuable possessions. Be sure to take pictures of serial numbers and, if possible, how much you paid for expensive items.

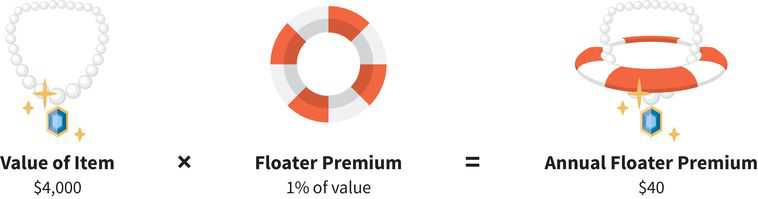

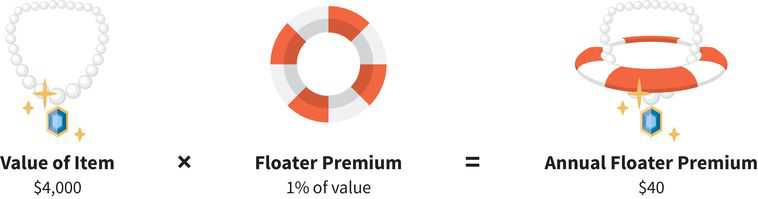

- 2. List anything with a value greater than $2,500, especially art, collectibles, precious metals, and gemstones. Nearly all insurance policies cap coverage for these types of personal property at $2,500 per item. So, if you have jewelry, art, guns, furs, collectibles, or other high-value property, you should purchase a personal property floater (sometimes called a rider) as a way to add extra coverage to your policy. As shown in the illustration below, the premium for items added on a floater will cost approximately 1% of the property’s value on a yearly basis.

Insurance companies often call adding specific property to a policy a

schedule.

- 3. Think carefully before adding an attractive nuisance on your property. Swimming pools, for example, tend to increase the premium level of an HO policy because pools are notorious for causing liabilities and losses. This is also true for basketball courts and large swing sets or playgrounds located on your property.

- 4. If you live in a flood zone, you will need to purchase separate flood insurance through your insurance agent and the Federal Emergency Management Agency’s National Flood Insurance Program (NFIP).

- 5. Make sure the HO policy provides inflation-adjusted replacement value. If you do not have replacement value, the insurance company will subtract wear and tear from the value of the lost property. You will then receive the depreciated value, which may not be enough to actually replace the lost property.

- 6. If you need it, increase the HO liability coverage (Part E) to at least $300,000 and purchase an umbrella policy or excess liability coverage in the amount of at least $1 million. An umbrella policy provides peace of mind just in case something bad happens. As shown in the following illustration, an umbrella policy provides comprehensive liability protection that goes beyond your home.

Umbrella liability coverage protects you anywhere you are, be it driving, on vacation, or at home, and is relatively inexpensive to purchase.

- 7. Consider adding identify theft protection to your HO policy. Although your premium will increase a bit, you will have some resources to access in case your identity gets stolen.

Cal used his technology skills to create an Excel spreadsheet to build an inventory of everything he owned. He also took photos of all the items and stored them in a file on his computer. He created links in his Excel spreadsheet to link the photos to the items listed. As a final safety measure, Cal saved his spreadsheet and photos to the Cloud. That way, if anything happened to his computer, he could still retrieve all the information.

-

- Personal Property Floater

- Adds extra insurance coverage for jewelry, art, guns, furs, collectibles, or other high-value property. Sometimes called a rider.

- Umbrella Policy

- An insurance policy that provides additional liability coverage beyond what is stated in a homeowner’s, renter’s, or personal automobile policy. Also called excess liability coverage.

3. Renter’s Insurance

Roughly 66% of Americans own their own home. For these people, having an HO policy in place is essential. But what about the one-third of Americans who rent their residence? The good news is that it is possible to purchase renter’s insurance. Renter’s insurance (sometimes called tenant’s insurance) is similar to an HO policy except that it is designed to provide you with property replacement and liability coverage rather than insurance to replace your residence.

-

- Renter’s Insurance

- Similar to an HO policy except that it is designed to provide you with property replacement and liability coverage rather than insurance to replace your residence. Sometimes called tenant’s insurance.

3a. Cost of Renter’s Insurance

Renter’s insurance is inexpensive.

- Policies cost between $150 and $300 per year for $25,000 of coverage.

- You might be able to get a policy for less if you buy the insurance from the company that sold you auto coverage, as you may qualify for a multi-policy discount.

Renter’s insurance is well worth its cost. As shown in the illustration below, most policies typically cover loss of personal property, personal liability, medical payments to others, and the loss of use of the property. Let’s look at renter’s insurance coverage in more detail.

-

If a fire destroys your apartment, renter’s insurance will also cover the cost of a hotel until your apartment is repaired or you can find a new place to stay, a big benefit compared to the small annual cost for a policy.

3b. Renter’s Insurance Coverage

Coverage associated with renter’s insurance tends to be broad. You can get reimbursed if a loss is caused by fire, smoke, theft, vandalism, windstorm, lightning, explosion, falling objects (e.g., tree limbs), snow, ice, sleet, water, or electrical surges. Better yet, the loss does not need to occur in your apartment or rented residence. Basically, renter’s insurance covers you no matter where you are. For example, if someone breaks into your car and steals your computer and phone, renter’s insurance will cover it!

If you are still living at home or are away at college, you may be covered under your parents’ HO policy. However, it is better for you to have your own policy. If you were to make a claim against your parents’ policy, their premiums may increase. Further, depending on other claims made, they could lose their coverage. So, for just a few hundred dollars a year, you can be independent and responsible.

In this lesson, you learned about the considerations for purchasing homeowner’s (HO) insurance and renter’s insurance. Your HO policy coverage consists of several parts, including replacement of your dwelling, other structures, and personal property. It also includes compensation for loss of use payments, medical coverage, and liability coverage. Once purchased, you need to manage your HO policy. This involves tasks such as using your technology skills for inventorying your personal items and looking into add-ons like flood insurance or an umbrella policy. You can use your problem solving skills to both determine your coverage and make wise choices about filing claims.

You might not be in your first home yet. Perhaps you’re still renting. If so, renter’s insurance is well worth the cost to protect yourself from liability and damage. The cost of renter’s insurance is relatively inexpensive. Renter’s insurance coverage includes loss of property, personal liability, medical payments to others, and loss of use property.

Source: This content has been adapted from Chapter 9.6 of Introduction to Personal Finance: Beginning Your Financial Journey. Copyright © 2019 John Wiley & Sons, Inc. All rights reserved. Used by arrangement with John Wiley & Sons, Inc.

Wiley and the Wiley logo are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries.