Table of Contents |

Let's start with a review of the general ledger. The general ledger aggregates all accounting records within an organization, in preparation for financial statements. The general ledger serves as the accounting system where entries are posted, and it contains entries from the general journal. Therefore, the general journal serves as the source for the general ledger. It provides summary detail for all of the accounts and rolling balances.

Now we will review some examples of general ledger transactions. Suppose you purchase $10,000 of equipment, for cash. This will involve a cash account, since you are paying for the equipment, as well as an equipment account.

Here is the ledger with its respective columns. Remember, each account is going to have its own ledger. The cash account has that unique identifier--1001--which comes from the chart of accounts. The date is reflected, as well as the reference from the general journal. Because you are paying cash, it's an asset; your cash is going down, so you're going to credit it. There will be a $10,000 balance in cash.

You also have equipment that you are purchasing. In the ledger, you'll see the same date and same reference. Since it's an asset and it's going up, you're going to debit your equipment. Therefore, equipment will also have a $10,000 balance.

The second transaction involves a purchase of $10,000 of equipment, on account. The accounts involved are equipment and accounts payable. The first ledger shows equipment--same date, same reference (from the general journal). Since your assets are going up, you're going to debit equipment, so there will be a $10,000 balance.

Next, let's look at accounts payable. Accounts payable is a liability, and if it's going up, you're going to credit your accounts payable. So, your accounts payable is also going to have a $10,000 balance.

The next transaction is a partial $5,000 payment, for equipment purchased on account. The accounts involved are accounts payable, because you're making a payment on equipment that you purchased on account, and cash, because you're making a payment.

Let's take a look at the ledgers, starting with accounts payable. You purchased that equipment on account, so you are starting with that $10,000 credit from before. Now, however, you are making a payment. You're making the payment on the same date, and note your journal entry reference. Since you are making a payment, your liabilities are going to go down. Liabilities are decreased with debits, so you have a $5,000 debit to accounts payable, which makes the balance in your accounts payable $5,000. Note the rolling balance concept illustrated within the general ledger.

Now it's time for the cash ledger. Check the journal entry reference. Since cash is an asset, and it's going down, there will be a $5,000 credit to your cash account, leaving a $5,000 balance.

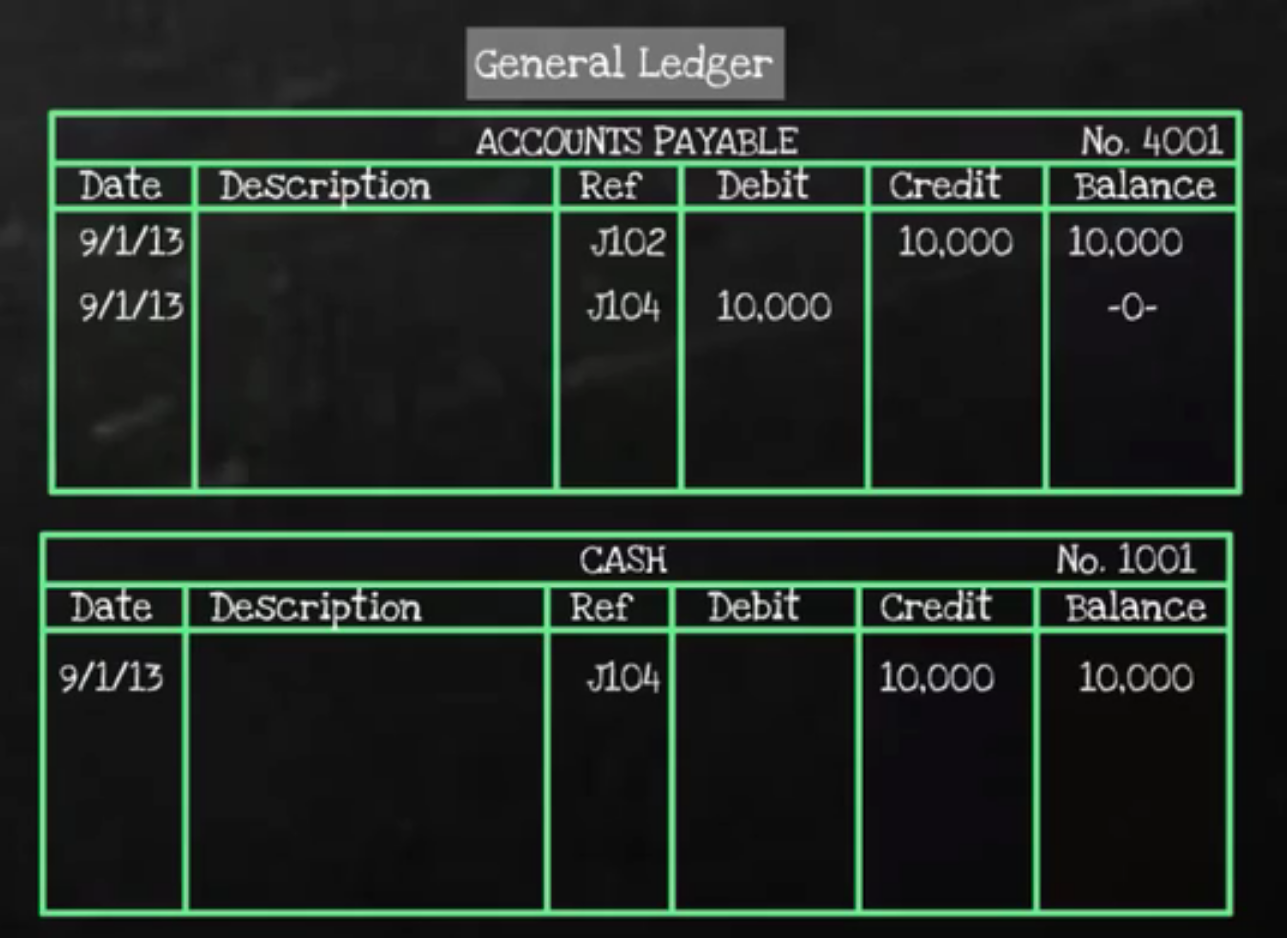

Next, you have a transaction involving a payment of $10,000 of equipment purchased on account. Accounts involved are accounts payable, as well as cash. Looking at the accounts payable ledger, you are now making a full payment for that equipment. So, if you had credited your accounts payable before, now you are paying it off. Therefore, you would debit your accounts payable, because it is a liability and it is decreased by a debit.

Now you can see that your balance in your accounts payable is zero. Since cash is an asset and it's going down--because you're making a payment--you credit your cash account and there is a $10,000 balance.

Next, suppose there is a withdrawal of $2,000 of cash, by the owner. Accounts involved are owner's draws, as well as cash. Starting with owner's draws, the owner is pulling money out of the business, so it's going to be a debit to the equity; it's decreasing the equity. So, there will be a $2,000 balance in the owner's draws. Cash is also going down, so it's going to be a credit, to cash, of $2,000.

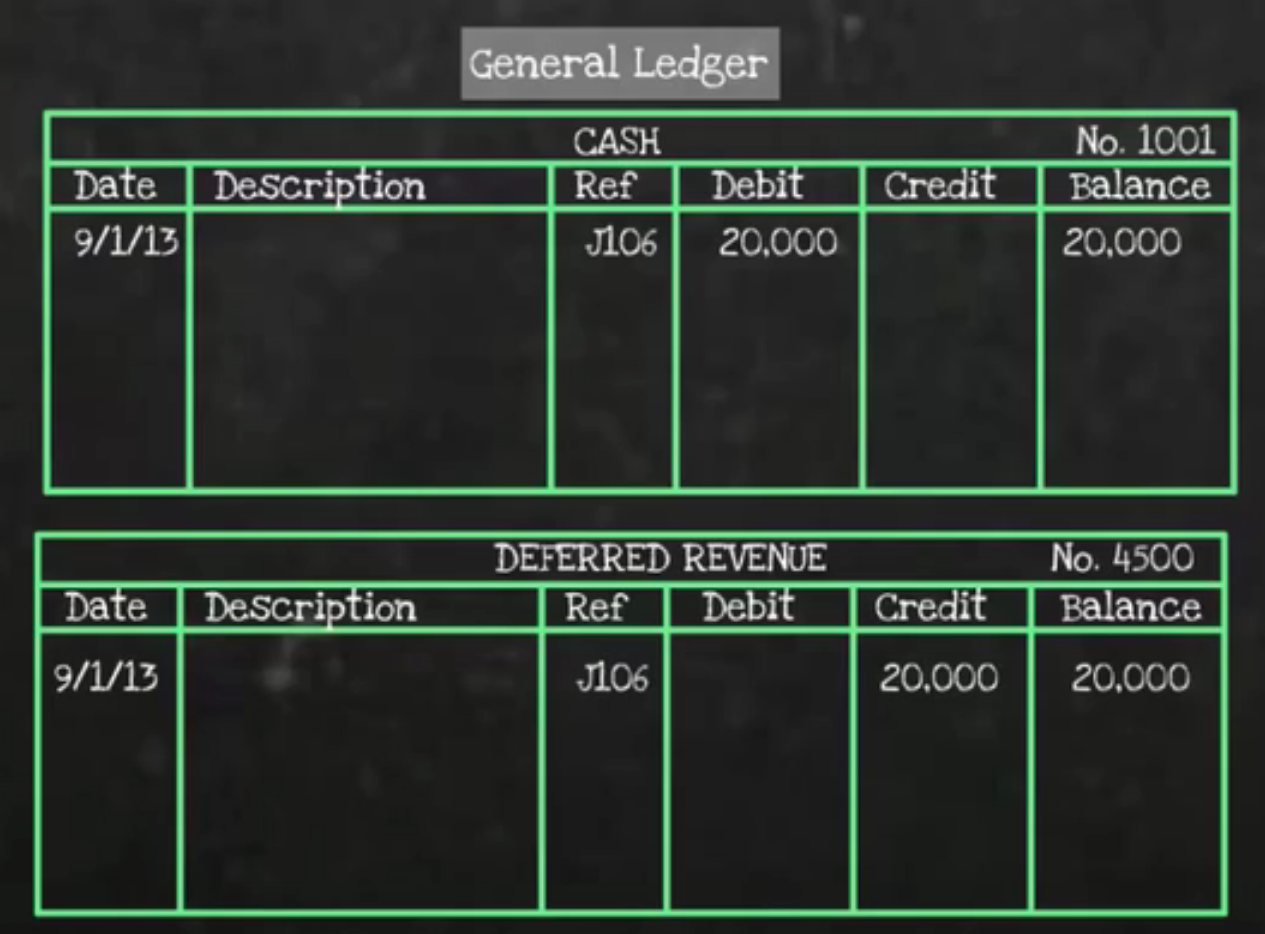

Suppose you're going to receive $20,000 of cash for future services. Accounts involved are cash, because you are receiving cash, as well as deferred revenue, because it is for future services that have not been performed yet. Since cash is going up, it's an asset, so you're going to debit cash for $20,000.

You also have deferred revenue for services that you have received payment for but haven't performed yet. Deferred revenue is a liability, and those are increased with credits, so you're going to put that $20,000 in your credit column, leaving a $20,000 balance in your deferred revenue.

Let's review one more transaction--a payment of $1,000 cash for future expense. Accounts involved are a prepaid expense--since it's a future expense and you haven't incurred that expense yet--and cash. Take a look at the general ledger, starting with your prepaid expense. Prepaid expense is an asset, so you're going to debit a prepaid expense for $1,000, leaving a $1,000 balance in your prepaid expense.

Next, cash is an asset, and since it's going down--because you're paying for prepaid expense--there is going to be a credit to your cash of $1,000, leaving a $1,000 balance in cash.

Source: Adapted from Sophia instructor Evan McLaughlin.