In this lesson, you will learn about the relationship between investment risk and return. You will also examine how risk can make you more productive as you seek to solve financial problems. Specifically, this lesson will cover:

-

Are you interested in a video preview of this lesson? Click play to learn about the risks and returns associated with investments. When you’re through, move on to section 1.

1. Risk Defined

In the world of finance, there is one certainty: you must take more risk to earn a higher return. Remember the Rule of 72? The Rule of 72 is a shortcut that tells you how long it takes to double your money when you have a fixed rate of return. For example:

- It takes about 72 years at a 1% rate of return to double invested money.

- It only takes about 12 years at a 6% rate of return to double invested money.

In this example, risk refers to the possibility of losing money. In order to earn 6%, you will need to take more risk. The

U.S. Securities and Exchange Commission (SEC) defines risk as the “degree of uncertainty and/or potential financial loss inherent in an investment decision.” Your financial risk tolerance, then, is the extent of your willingness to engage in financial behavior that has the possibility of a loss.

-

- Rule of 72

- Provides an estimate of how long it will take you to double your money, calculated by dividing 72 by the interest rate.

1a. Types of Risk

Risk comes in many forms and often involves volatility. You can think about volatility as the value of an asset fluctuating up and down, or the variability of returns over time. An asset that can lose value is considered to be riskier than an asset that cannot go down in value. However, there is more to understand about risk than volatility and the potential for loss. Let’s look at a few types of risk that can really throw you off course during your financial journey:

-

Inflation risk occurs when prices increase over time. This is often overlooked when making financial plans.

-

Business risk is the possibility that a company in which you invest will be forced to close.

-

Interest rate risk is the chance that general interest rates will increase, which will reduce the value of most investments (see Hint).

-

Liquidity risk occurs when you cannot sell something you own because of a weak market, meaning others aren’t willing to buy what you are selling.

-

When interest rates increase, the value of most investments will decrease.

-

- Inflation Risk

- The danger that rising prices in the economy will erode purchasing power. Also called purchasing power risk.

- Business Risk

- The possibility that a company in which you invest will be forced to close.

- Interest Rate Risk

- The chance that general interest rates will increase, which will reduce the value of most investments.

- Liquidity Risk

- Occurs when you cannot sell something you own because of a weak market, meaning others aren’t willing to buy what you are selling.

1b. Inflation Risk

Let’s look at inflation risk in more detail. You should care about inflation because inflation reduces the value of what a dollar can buy in the future. The following table provides an example of how inflation works in practice.

- The table highlights how the average price of several commonly purchased items increased from 1980 to 2015.

- Recall that by using time value of money calculations, you can estimate that the average annual increase in prices from year to year was approximately 3.06% during this time period. This general increase in prices is called inflation.

|

Item

|

1980 Cost

|

2015 Actual Cost

|

2015 Projected Cost Based on Average Annual Inflation of 3.06%

|

Actual Item Annual Inflation Rate

|

Was 2015 Price Above or Below What Was Expected?

|

|

Gasoline (1 gallon)

|

$ 1.24

|

$ 2.44

|

$ 3.58

|

1.95%

|

Below

|

|

Bread, white (1 pound)

|

$ 0.51

|

$ 1.44

|

$ 1.46

|

3.01%

|

About the same

|

|

Ground beef (1 pound)

|

$ 1.83

|

$ 4.25

|

$ 5.26

|

2.44%

|

Below

|

|

Eggs (1 dozen)

|

$ 0.84

|

$ 2.47

|

$ 2.42

|

3.13%

|

About the same

|

|

Apples (1 pound)

|

$ 0.63

|

$ 1.36

|

$ 1.81

|

2.22%

|

Below

|

|

Oranges (1 pound)

|

$ 0.36

|

$ 1.30

|

$ 1.05

|

3.74%

|

Above

|

|

Tuition, public 4-year school

|

$808.00

|

$9,410.00

|

$2,320.00

|

7.27%

|

Above

|

Source: U.S. Bureau of Labor Statistics, Consumer Price Index (CPI) databases.

The amounts shown in the table above represent an average annual rate of inflation equal to 3.06% annually. It is worth noting that during the 35 years represented in the table, wages and salaries actually went up faster (3.93%) than general inflation. However, some big-ticket items, such as tuition, grew much faster than inflation and wages during this time period. Stated another way, increases in wages did not keep pace with the rising cost of going to school.

-

Inflation does not always occur uniformly. As the table shows, the price of some items increased faster or slower than general inflation during that time period.

Risk is a consideration in many of the decisions we make. Describe a risky financial decision made by you or someone else. What were the downsides of the decision? What were the upsides? In the end, did the decision make you more or less productive?

-

- Inflation

- The average annual increase in prices from year to year.

2. Saving and Investing: An Introduction

You should now be convinced that you need to be willing to take some risks to accumulate wealth. You have two basic choices when it comes time to decide how to put your money to work.

-

Savings: Money you put aside for short-term goals.

-

Investments: Assets that you purchase to reach long-term goals.

However, you won’t necessarily want to pick one option over the other. In general, you will want to combine both options over your financial journey to accumulate wealth.

-

- Savings

- Money you put aside for short-term goals.

- Investment

- An asset that you purchase to reach long-term goals.

2a. Combining Savings and Investments

For example, consider Lucy, who begins saving and investing at age 22 and lives to age 100. Each year, Lucy (1) saves $250 in a safe and secure account earning 3% interest, and (2) invests $2,000 in a fund that generates an average 7% rate of return over time.

- As shown in the following line graph, Lucy’s savings and investments combine to create financial wealth, which is then used to fund her current financial objectives and future goals.

Note the peak in the graph, which is when Lucy retires. If Lucy has saved and invested wisely, she will be able to draw down her accumulated wealth to supplement her income needs during retirement.

- Note how Lucy’s wealth increases slowly over time. The reason is that money held in savings accounts generally earns less – has a lower return – than investments. In contrast, her investment returns increase much more rapidly, especially over time as early returns experience the power of compound growth.

Now consider Sam, who did not start saving and investing until age 30. However, at age 30, Sam experiences a large unexpected expense that required him to borrow $7,000. Essentially, this emergency slows Sam’s overall ability to amass wealth over his life span (see the previous graph). Sam may have a challenging time pulling sufficient money from savings and investments later in life to fund his retirement.

Sam’s example also shows the need to establish and maintain an adequate and liquid emergency fund and appropriate insurance (discussed in a later lesson). Because maintaining liquidity is so central to the concept behind saving and investing, let’s discuss it in more detail next.

2b. Maintaining Liquidity

Liquidity refers to how quickly you can convert an asset into cash.

- Cash in your pocket is the most liquid asset, followed by assets held in banks and credit unions.

- Highly liquid assets will almost always generate lower returns.

The illustration below shows the relationship between liquidity and returns.

There are times when you should be perfectly happy to accept higher liquidity and lower returns. For example, in Sam’s case, he needed an emergency fund to quickly pay for his unexpected expenses.

- An emergency fund needs to be very liquid, that is, immediately accessible for use in case of unexpected expenses (such as a major car repair) or lost income (reduced number of hours worked).

- A basic guideline is that you should have between three and six months of living expenses saved for emergencies.

- For those who need high liquidity and convenience, holding money in a bank or credit union as an emergency fund or as general savings makes a lot of sense. These accounts are federally insured up to $250,000 per account holder through the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Share Insurance Fund (NCUSIF).

Throughout your financial journey, you need to balance risk, return, and liquidity when making saving and investment decisions. An investment pyramid can help you do this.

Typically, you will take risks to solve or prevent a financial problem. Your goals and personal financial plan determine the amount of risk you are willing to take with regard to any financial decision.

-

- Liquidity

- How quickly you can convert an asset into cash.

3. The Investment Pyramid

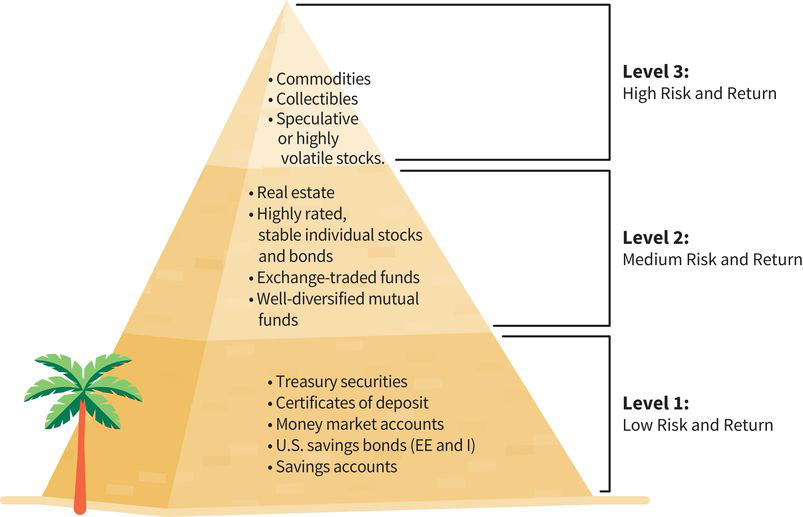

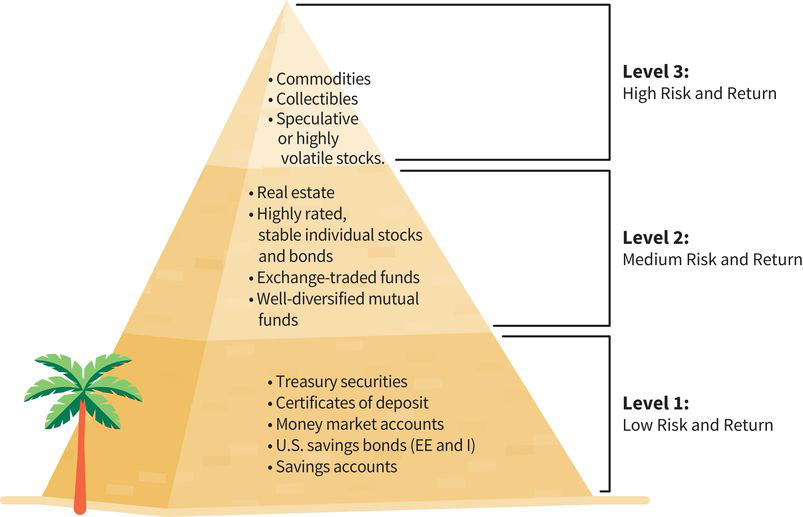

As any seasoned investor will tell you, a good investment is one that offers low risk and high returns. Unfortunately, it is difficult to find such an investment. Usually, you must make a tradeoff between risk and return. This concept of a tradeoff is summarized by the investment pyramid shown in the following illustration. Think of the pyramids like those in Egypt, which require a solid foundation before the top layers can be added.

You already know the definition of risk. In this lesson, you learned that there are several types of financial risk, one of which is inflation risk. This is the risk that general interest rates might increase, which will reduce the value of most investments. Often, you will consider a risk as you seek to solve a financial problem. You explored how taking these financial risks can lead to more productivity.

This lesson also gave you an introduction to saving and investing. In your financial journey, your combined savings and investments is what grows wealth. Although all investments come with some degree of risk, the investment pyramid showed you how high-risk investments typically yield high returns. You must understand the liquidity of each investment to know how quickly it can be converted to cash, especially in the event of an emergency. Generally, the lower the return, the more liquid an asset is.

Source: This content has been adapted from Chapter 7.1 of Introduction to Personal Finance: Beginning Your Financial Journey. Copyright © 2019 John Wiley & Sons, Inc. All rights reserved. Used by arrangement with John Wiley & Sons, Inc.

Wiley and the Wiley logo are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries.