Table of Contents |

Let's review what we have learned about T-accounts.

T-accounts are a shorthand method of displaying journal entries and balances within individual accounts. T-accounts are used to record increases and decreases in specific accounts within the different account groups. It is a way to organize the debits and credits within specific accounts, recording those increases and decreases. Remember, debits are on the left side and credits are on the right side, so T-accounts are a simple method to analyze account activity.

Let's review the actual T-account structure, below. There are different attributes that need to be put into the T-account:

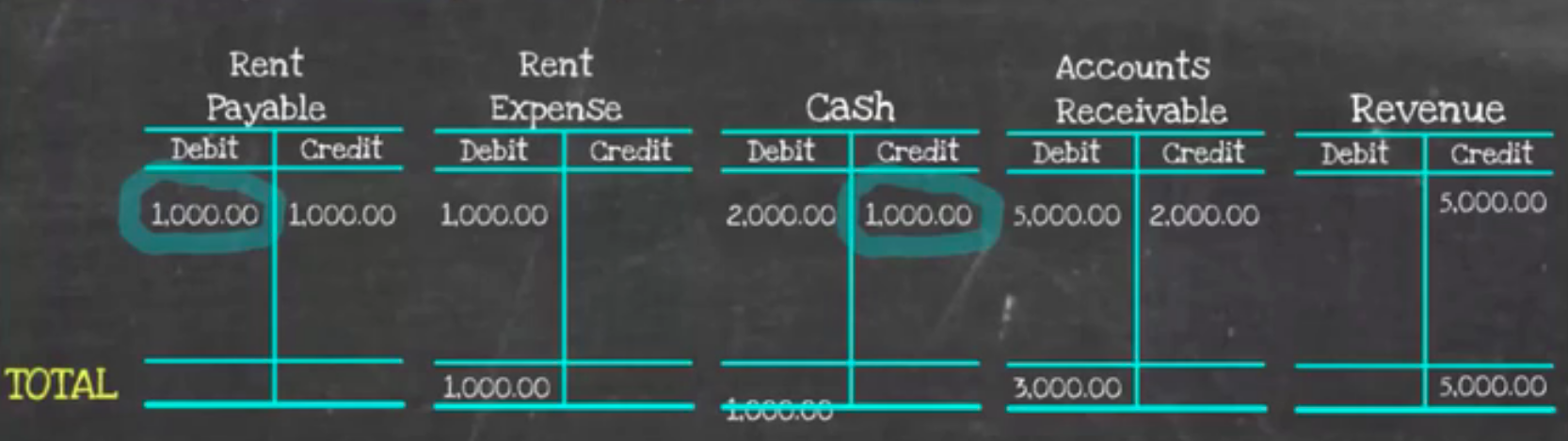

Now let's look at an application of T-accounts using accruals. Suppose your first transaction involves recording a $5,000 sale on account. Which accounts are involved? Well, you made a sale, so it's going to be revenue. Revenues are increased with credits, so you're going to put that $5,000 in the credit column, leaving you with a total of $5,000.

Now, what is the other T-account involved? Since it was a sale made on account, you haven't received the money yet, so that must be an accounts receivable. That is an asset, and assets are increased with debits. Therefore, you have a $5,000 debit, leaving a total of $5,000 in the debit column. Remember, you must perform that quick check at the end. Does your debit equal your credit? It does. You can move on to your next transaction.

Next, you're going to be recording a $2,000 deposit that was received for that $5,000 sale that you made on account. You received cash for the accounts receivable, because you received partial payment; therefore, your revenue doesn't change. However, you know that your cash is impacted, because you've received money. Cash is an asset, so you put that $2,000 in the debit column.

Your accounts receivable is in the other T-account. You have the $5,000 from your last transaction, and since accounts receivable is going down, you put $2,000 in the credit column. Now you have money in both columns, so since your debit column of $5,000 exceeds your credit column of $2,000, the difference of $3,000 goes on the debit side. Final check. Does the debit equal to credit? It does. Let's go to the next transaction.

Next, you will be recording $1,000 of rent expense, which has been incurred but not paid yet. Again, which accounts are involved? Well, you incurred an expense, so you need to record expenses incurred on account. However, you haven't paid that expense yet. Your revenue and accounts receivable aren't impacted, and your cash stays the same. Therefore, the first T-account to look at is rent expense. You incurred an expense, and expenses are increased with debits. Therefore, you have a $1,000 debit to your rent expense.

The other T-account involved is rent payable, which is money that you owe. It's a liability, and liabilities are increased with credits. So, you have a $1,000 credit in your rent payable. Last check--rent expense debit of $1,000, rent payable credit of $1,000. Debits and credits match. Let's move on to the last transaction.

The last transaction involves recording a $1,000 payment for rent expense incurred on account. Now you're going to actually pay that expense that you incurred in the last transaction. This is cash that is paid for expense on account, so once again, your revenue and accounts receivable are not impacted. Your rent expense is not impacted, because you already recorded it. Therefore, the first T-account you need to look at is cash, because cash was paid. Because cash is an asset, it is reduced by credits, so you will put that $1,000 in the credit column. Now, a $2,000 debit is greater than a $1,000 credit, the difference being $1,000, so you will put that in your debit column.

Finally, let's tackle rent payable. This is going to be a debit, because you are reducing your liability. Because you have a $1,000 debit and a $1,000 credit, there is no balance in the rent payable account. Final check, does debit equal credit? It does, so now you can wrap it up!

Source: Adapted from Sophia instructor Evan McLaughlin.