Table of Contents |

T-accounts are a shorthand method of displaying journal entries and balances within individual accounts. T-accounts are used to record increases and decreases in specific accounts within the different account groups. It is a way to organize the debits and credits within specific accounts, recording those increases and decreases. Remember, debits are on the left side and credits are on the right side.

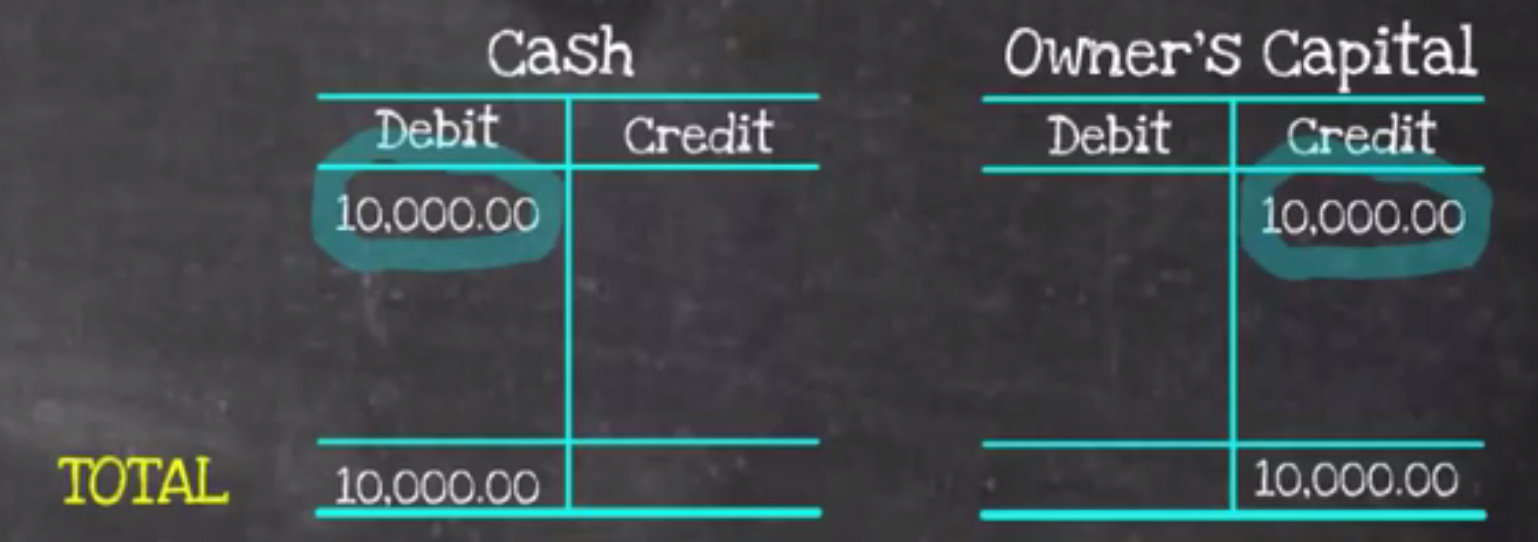

Let's look at an actual T-account structure, below. There are different attributes that need to be put into the T-account:

Now, using our new knowledge of a T-account structure, let's apply it to a transaction. Suppose you are creating a business with a $10,000 cash investment. What accounts will you use? What accounts will require T-accounts?

You need cash, because you're receiving a cash investment. Cash is an owner contribution, which is your first clue. The first T-account needed is cash. When cash is increased, because it's an asset, it's a debit. Therefore, you will have a $10,000 debit into your cash T-account.

What other account is affected? Owner's capital, a contribution made by owners, is increased with a credit, so you will put $10,000 on the credit side. Total credits are $10,000.

Don't forget the final check and balance. Do the total debits equal the total credits? The answer is yes: $10,000 debit, $10,000 credit. You are good to move on!

The next scenario involves the transaction. You record a $5,000 cash sale. What accounts are impacted? Cash is received for a sale, so owner's capital stays the same, since it's not impacted. However, there is the cash from the transaction, so you know that cash is impacted, because you've received $5,000 more. Therefore, your cash goes up, and your total cash is now $15,000.

Note, you now need one other T-account. You need a T-account for revenue, because you made a sale. You know that revenue is increased by credits, and because you made a sale, you have a $5,000 credit to your revenue. Check to ensure that your debit of $5,000 equals your credit of $5,000. Does it? Yes. You are good to go!

Now you record a $1,000 cash payment for salaries expense. Which accounts are impacted? Cash payment for an expense. Owner's capital and revenue stay the same; neither of these are impacted.

However, your cash is impacted again. You have the $10,000 and the $5,000 from the last two transactions, but this time, cash is going out the door, so you need to reduce cash with a credit of $1,000. This leaves you with a $14,000 debit in your cash.

One final T-account is impacted: expenses. You have salaries expense, and your expenses are increased with debits. You have a $1,000 debit to your salaries expense.

It's time for one last check and balance. Does that $1,000 debit to your salaries expense equal that $1,000 credit? It does. Once again, you are good to go!

Source: this work is adapted from sophia author Evan McLaughlin.