Table of Contents |

What does the cost of groceries have to do with international relations? How do you know if it’s the right time to buy a new computer or look for a new job? Should you save your holiday bonus or spend it?

The study of economics helps you answer these questions and more by examining how society produces, consumes, and exchanges wealth and resources every day. In fact, everything we do—from the choices we make about our careers to the cost of living and how much we’re able to spend and save—is influenced by the economy. And understanding the science of economics can give us the confidence to navigate our personal financial future.

.

.

In each lesson in this course, we will introduce you to concepts in economics and personal finance, and you’ll explore the essential skills that will help you to improve your personal, professional, and financial well-being. We’ll also discuss what it means for you to invest in your most valuable resource… you!

Any exploration into economics starts with the basics. Let’s look at how the foundational concepts of economics impact our decision making to help us solve problems in our daily lives.

We all have wants and needs. For example, you might want to buy that new touring bicycle at the bike shop. But can you afford it? If the bike is too costly, then that purchase is not within reach. Scarcity is a limitation or the gap between limited resources and excessive wants and needs. Scarcity is what forces us to prioritize our spending decisions and problem solve. When faced with such decisions, a conscious consumer will usually choose to satisfy their basic needs before pursuing those ever-so-tempting wants.

Problem Solving: Skill Reflect |

A trade-off decision is when we choose one activity as more valuable than another. For example, you choose to spend time learning a new software program to file your own taxes instead of going hiking with friends at the lake.

EXAMPLE

Ava is a single working parent who is trying to juggle the cost of going back to school with her necessary living expenses. It can be a real challenge. However, last month she unexpectedly inherited $10,000 from a relative. The money presents Ava with several options. She can use the money to pay for school, put it into a savings account, or use it to purchase a new vehicle.Whatever Ava decides, she will be making a trade-off decision. For example, if her decision is to save the money, her trade-off is not using the money to pay for school or purchase a new vehicle. In economics, when one decision is made, it often means a different decision cannot be made. Such decisions are unique and personal based on your financial situation.

An opportunity cost refers to something an individual must give up or do without when they make one choice over another. In other words, what are the costs associated with choosing one of two options? Let’s look at an example.

EXAMPLE

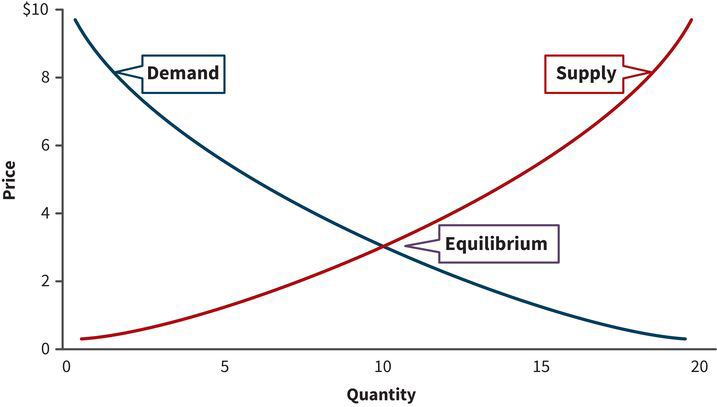

Imagine you’ve earned a $1,000 bonus from your employer. You choose to set the money aside for a rainy day fund rather than investing it in the stock market. The cost of that decision is the loss of any profits you could potentially make in the stock market.At some point during your academic career, you probably have seen a supply and demand graph, like the one shown in the image below, which illustrates the fundamental building blocks of modern economics.

EXAMPLE

Imagine a dealer who purchases your vintage video games. She will almost always be willing to pay more for a game that she knows can sell quickly (i.e., there is high demand). This is true even if there are thousands of these games available (i.e., high supply). If the demand is high enough, then she will be willing to pay you more because she knows she can flip the asset quickly.This rule is evident in pawnshops where collectibles, such as gold and silver, have small spreads between the bid and ask price because these assets have strong local and worldwide demand. However, with other niche collectibles, like baseball cards, the spread may be small, not because the card is not valuable, but because the market is so small.

Agility: Skill Tip |

Inflation generally happens so slowly that you hardly see it. One reason inflation is so elusive is that at any time some prices are increasing, some remain the same, and some prices fall. Think about tuition compared with the price of electronics. Tuition at colleges and universities has been increasing steadily for more than 30 years, while the cost of most household electronics has been declining steadily. Even so, prices of goods and services generally tend to increase over time. Economists are comfortable assuming that prices usually go up by about 2.5% to 3.0% per year. (Although rare, note that you may encounter deflation at some point during your lifetime financial journey. Deflation occurs when general prices decline.)

The consumer price index (CPI) is one measure that you can use to determine if inflation is occurring.

| Price in 1983 |

Inflation-Adjusted Price in 2017 (2.67% per year) |

Actual Prices in 2017 | |

|---|---|---|---|

| Average cost of a home | $89,800 | $218,945 | $295,000 |

| Price of a postage stamp | $0.20 | $0.49 | $0.49 |

| Cost for a gallon of gas | $1.24 | $3.02 | $2.50 |

| Price of a dozen eggs | $0.86 | $2.10 | $1.45 |

| Tuition/Room/Board | $3,877 | $9,453 | $16,500 |

| Median household income | $20,885 | $50,920 | $56,516 |

Source: www.bls.gov/data/inflation_calculator.htm.

Your ability to stay flexible and adapt as situations and circumstances arise is part of practicing your agility skill. In this course and your career, practicing agility will not just help you make sound financial decisions, it will help you solve a range of personal and professional problems. Part of honing your agility skill, for example, is understanding how to pivot or change directions to achieve your goals, such as knowing when to change to a new health insurance provider to lower your insurance premiums or changing your workout routine so you can build up the endurance you need to compete in a marathon.

Source: Sections 2d and 2e have been adapted from Chapter 8 of Introduction to Personal Finance: Beginning Your Financial Journey. Copyright © 2019 John Wiley & Sons, Inc. All rights reserved. Used by arrangement with John Wiley & Sons, Inc.

Wiley and the Wiley logo are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries.