Table of Contents |

Bank and investment accounts appreciate in value according to compounding interest. For many, the account has an annual percentage rate (APR) that is compounded periodically throughout the year. This means that a portion of the APR is applied each time the interest is compounded.

EXAMPLE

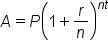

If interest is compounded quarterly, one-fourth of the interest is applied each quarter, for a total of four times per year.We can represent compounding interest using the following formula:

In this formula,

number of years.

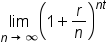

number of years.When interest is compounding continuously, we can think of the variable n (the number of times per year interest is compounded) as being infinitely large. How do we make sense of our formula if n is an infinitely large number? Let's isolate the part of our formula that relies on the variable n, and consider when n approaches infinity:

As it turns out, as n gets infinitely larger, the expression  simplifies to

simplifies to  . Recall that

. Recall that  is a mathematical constant, approximately equal to 2.718282. Having this in mind, we can adjust our interest formula for continuously compounding interest:

is a mathematical constant, approximately equal to 2.718282. Having this in mind, we can adjust our interest formula for continuously compounding interest:

In this formula,

Now that we have a formula to use when interest is compounded continuously, let's use it to solve some problems with account balances.

EXAMPLE

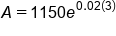

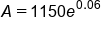

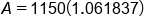

An account has an initial balance of $1150.00 and has an APR of 2%, which is compounded continuously. What is the balance of the account after 3 years, assuming no additional deposits or withdrawals are made?

|

Plug in

|

|

Evaluate multiplication in exponent |

|

Apply exponent to e |

|

Multiply by principal balance |

|

Our solution |

We can also use the formula for continuously compounding interest to solve for the time it takes for the account to reach a certain value.

EXAMPLE

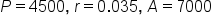

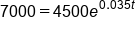

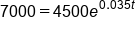

A savings account has a balance of $4,500. The interest rate of the account is 3.5% annually, which is compounded continuously. How long will take for the account to reach a value of $7,000, assuming no additional deposits or withdrawals are made?

|

Plug in

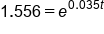

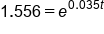

|

|

Solve for t |

is an exponent here. The exponent

is an exponent here. The exponent  is applied only to the mathematical constant e, not the principal balance, P. So our first step should always be to divide both sides of the equation by the principal.

is applied only to the mathematical constant e, not the principal balance, P. So our first step should always be to divide both sides of the equation by the principal.

|

Divide by 4500 |

|

Solve for t |

|

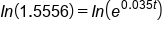

Take the natural log of both sides |

|

Appy the Power Property of Logs |

|

Simplify the left side with

|

|

Divide both sides by 0.035 |

|

Evaluate fraction |

|

Our solution |

|

Our solution |

, this is simply equal to 1.

, this is simply equal to 1.

Source: ADAPTED FROM "BEGINNING AND INTERMEDIATE ALGEBRA" BY TYLER WALLACE, AN OPEN SOURCE TEXTBOOK AVAILABLE AT www.wallace.ccfaculty.org/book/book.html. License: Creative Commons Attribution 3.0 Unported License